Not known Facts About Dubai Company Expert Services

Wiki Article

The Greatest Guide To Dubai Company Expert Services

Table of ContentsA Biased View of Dubai Company Expert ServicesThe Best Strategy To Use For Dubai Company Expert ServicesDubai Company Expert Services Fundamentals ExplainedSome Known Incorrect Statements About Dubai Company Expert Services Dubai Company Expert Services Things To Know Before You Buy

As the little child said when he left his initial roller-coaster trip, "I like the ups but not the downs!" Here are some of the threats you run if you intend to begin a local business: Financial danger. The monetary sources required to begin and also grow a business can be substantial.Time dedication. Individuals frequently start companies to ensure that they'll have even more time to spend with their households. Running a business is extremely taxing. In concept, you have the freedom to require time off, but in fact, you may not have the ability to flee. As a matter of fact, you'll probably have much less spare time than you 'd have working for somebody else.

6 "The Entrepreneur's Workweek" (Dubai Company Expert Services). Vacations will be difficult to take and will commonly be interrupted. Over the last few years, the difficulty of escaping the task has been intensified by cell phones, i, Phones, Internet-connected laptop computers and also i, Pads, and also numerous local business proprietors have actually come to be sorry for that they're constantly reachable.

Some individuals know from a very early age they were suggested to possess their very own service. Others find themselves beginning a company because of life modifications (being a parent, retirement, shedding a task, etc). Others may be utilized, yet are questioning whether the duty of organization owner/entrepreneur is best for them. There are a number of benefits to starting a business, however there are additionally runs the risk of that need to be examined.

The Facts About Dubai Company Expert Services Uncovered

For others, it might be overcoming the unidentified and also striking out by themselves. Nonetheless you define personal fulfillment, starting a brand-new business might hold that guarantee for you. Whether you watch beginning a service as an economic need or a way to make some extra income, you may locate it generates a new source of revenue.Have you examined the competitors and also thought about exactly how your certain organization will do well? Detail your service goals. What do you intend to complete and what will you think about a success? Another large decision a local business proprietor faces is whether to own business personally (single proprietorship) or to create a separate, statutory company entity.

An advantage corporation is for those company owner who wish to make an earnings, while also offering a charitable or socially beneficial objective. You can develop your company entity in any kind of state Proprietors commonly choose: the state where the service is situated, or a state with a recommended regulating statute.

The entity can be a different taxable entity, indicating it will certainly pay income tax obligations on its very own tax return. The entity can be a pass-through entity, implying the entity doesn't pay the tax obligations but its income passes with to its owner(s).

All about Dubai Company Expert Services

Sole traders as well as partners in a partnership pay approximately 20% to 45% revenue tax obligation while companies pay firm tax obligation, generally at 19%. As long as company tax rates are lower than earnings tax obligation prices the advantage will certainly commonly be with a minimal business. As salary payments to employees, a business can additionally pay rewards to its investors.Offered a minimum degree of salary is taken, the supervisor maintains entitlement to certain State advantages with no employee or employer National Insurance Contributions being payable. The equilibrium of compensation is often taken as returns, which might endure less tax than income and which are not themselves based on National Insurance coverage Contributions.

This may be helpful when the withdrawal of more income this year would certainly take you right into a higher tax brace. You must constantly take expert tax obligation or monetary recommendations in the light of your particular conditions, and this area is no exemption. No recommendations is provided here.

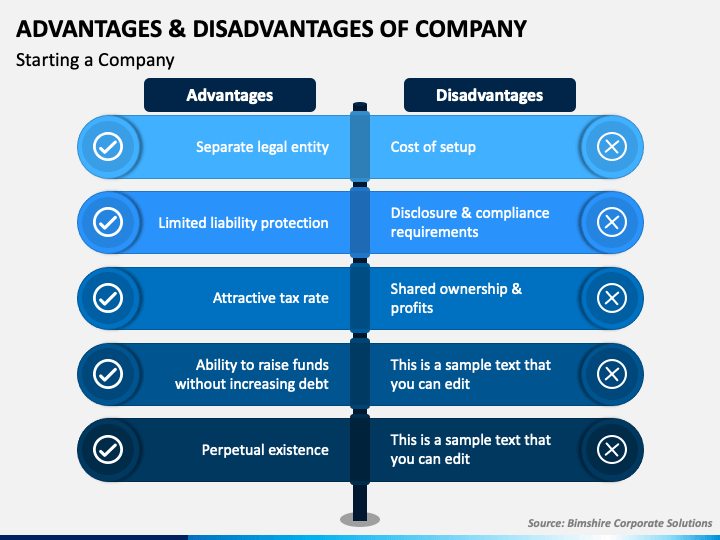

The most common kinds of corporations are C-corps (dual taxed) and also S-corps (not double strained). Advantages of a corporation include personal liability security, company security and also continuity, as well as much easier accessibility to capital. Negative aspects of a company include it being time-consuming and also subject to dual taxation, as well as having rigid formalities as well as procedures to adhere to.

The 15-Second Trick For Dubai Company Expert Services

One alternative is to framework as a company. There are several reasons why incorporating can be useful to your business, there are a couple of disadvantages to be aware of. To aid you figure visit the website out if a my latest blog post firm is the most effective legal framework for your business, we spoke to legal experts to break down the different types of companies, and the advantages as well as drawbacks of incorporating.For lots of organizations, these demands consist of producing company bylaws and also declaring write-ups of incorporation with the assistant of state. Preparing all the info to submit your short articles of incorporation can take weeks or perhaps months, but as quickly as you have actually successfully filed them with your assistant of state, your company is formally identified as a corporation.

Companies are typically controlled by a board of directors chosen by the shareholders."Each owner of the corporation normally possesses a percent of the firm based on the number of shares they hold.

A firm provides more personal asset responsibility security to its proprietors than any type of various other entity kind. For instance, if a corporation is taken legal action against, the investors are not directly in charge of corporate debts or legal commitments also if the firm does not have enough cash in possessions for payment. Individual responsibility security is among the major factors businesses choose to integrate.

Getting My Dubai Company Expert Services To Work

This access to funding is a luxury that entity types don't have. It is terrific not only for expanding a company, however also for saving a company from declaring bankruptcy in times of need. Although some More Bonuses firms (C companies) are subject to dual taxation, various other company frameworks (S corporations) have tax benefits, depending upon how their revenue is distributed.Any type of revenue assigned as proprietor salary will be subject to self-employment tax obligation, whereas the rest of the business rewards will be strained at its own degree (no self-employment tax obligation). A firm is not for everybody, and also it might wind up costing you more money and time than it's worth. Prior to becoming a corporation, you must understand these potential negative aspects: There is a prolonged application process, you have to follow rigid formalities and methods, it can be expensive, as well as you may be double tired (depending upon your firm structure).

You need to follow many procedures and hefty regulations to maintain your corporation standing. For instance, you need to follow your laws, keep a board of directors, hold annual conferences, maintain board mins and create annual reports. There are also limitations on specific firm kinds (as an example, S-corps can only have up to 100 investors, who need to all be U.S. There are numerous kinds of companies, including C firms, S companies, B corporations, shut companies and not-for-profit corporations. Each has it advantages as well as disadvantages. Some choices to companies are single proprietorships, partnerships, LLCs and cooperatives. As one of one of the most common types of firms, a C company (C-corp) can have a limitless variety of shareholders and also is exhausted on its revenue as a separate entity.

Report this wiki page